iowa inheritance tax rate

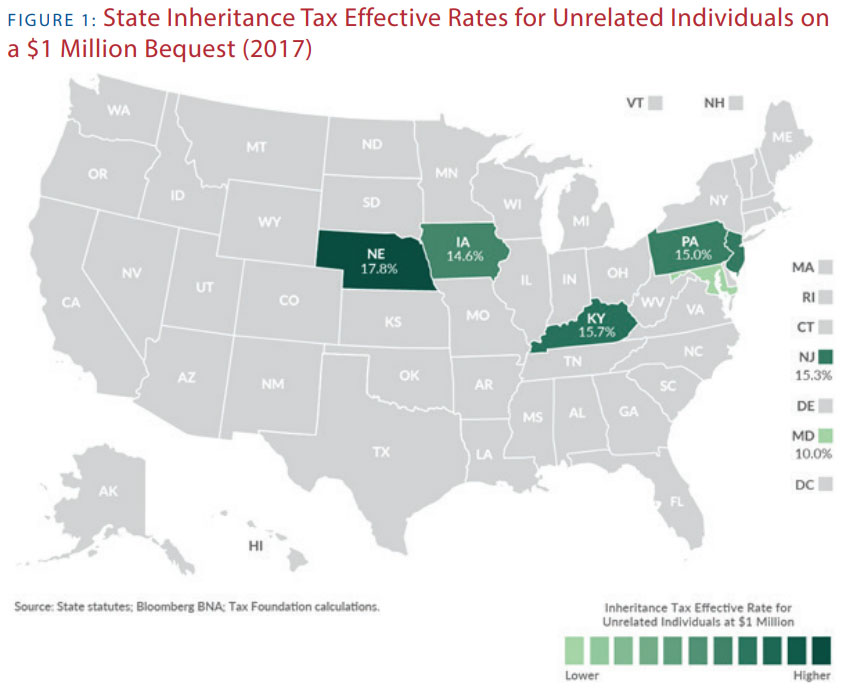

Which is better than our neighboring state of Nebraska which has the highest top inheritance tax rate of 18 In case you were wondering there is no federal inheritance tax to worry about. Value of inheritance.

Eight Things You Need To Know About The Death Tax Before You Die

Iowa inheritance tax is a tax paid to the State of Iowa and is based upon a persons beneficiary or heir right to receive money or property that was owned by another person decedent at the time of death and is passing from the decedent to.

. If instead you are a sibling or other non-linear ancestor then you are subject to pay an inheritance tax on your portion. Iowas max inheritance tax rate is 15. See the Iowa Inheritance Tax Rate Schedule Form 60-061 090611.

Unlike federal estate taxes which are paid by the estate Iowas inheritance tax is paid by the beneficiary. Iowa inheritance tax rates If you are the descendants brother sister half-brother half-sister son-in-law or daughter-in-law you will pay tax rates ranging from 4 on the first 12500 of inheritance up to 8 on the value of inheritances worth more than 150000. For more information on exempt beneficiaries check out Iowa Inheritance Tax Law Explained.

The rate is determined by the amount of the inheritance received and range from anywhere between 5 and 15. Adopted and Filed Rules. If the net estate of the decedent found on line 5 of IA 706 is less than 25000 the tax is zero.

Learn About Property Tax. File a W-2 or 1099. The rate ranges from 5 to 10 based on the size.

Even if no tax is. It has an inheritance tax with a top tax rate of 18. Read more about Inheritance Tax Rates Schedule.

Schedule B beneficiaries include siblings half-siblings sons-in-law and daughters-in-law and the rate is 5 to 10. IA 8864 Biodiesel Blended Fuel Tax Credit 41-149. There are also Tax Rate F beneficiaries which are unknown heirs and their tax rate is 5.

Law. Iowa Estate Tax IA 706 The Iowa estate tax is the amount of money the Internal Revenue Service Code allows as a credit against the federal estate tax owed by the estate less the Iowa inheritance tax paid. If the person died on or before 31 December 2021 no IHT205 form needs to be completed if it is an excepted estate or they do not need a probate.

50001-100K has an Iowa inheritance tax rate of 12. In addition to the Iowa inheritance tax there are other Iowa state taxes which concern estate property. Aunts uncles cousins nieces and nephews of the decedent.

These are briefly described below. The following Inheritance Tax rates will apply to a decedents beneficiary who is a. These tax rates are based upon the relationship of the beneficiary to the deceased with no inheritance tax due from spouses and direct lineal descendants or ascendants ie.

With passage of the new bill if one were to pass away in 2021 the inheritance tax imposed on the inheritor would be. While there is. Iowa inheritance Tax Rate C 2020 Up to 50000.

For a brother or sister including half-brothers and half-sisters son-in-law or daughter-in-law the following tax rates apply. How much is the inheritance tax in Iowa. Iowa does have an inheritance tax which beneficiaries are responsible for paying on their inheritance.

Inheritance Tax Bill Passes - Fairbury Journal News 2022 State Tax Changes Effective January 1 2022 Tax. 60-061 01032022 Pursuant to Iowa Code chapter 450 the tax rates are as follows. 619 a law which will phase out inheritance taxes at a rate of 20 per year and completely eliminate the tax by January 1st 2025.

In addition to the Iowa inheritance tax there are other Iowa state taxes which concern estate property. A summary of the different categories is as follows. Inheritance Deferral of Tax 60-038.

Iowa Inheritance Tax Rates. Amounts up to 12500 are taxed at 5. Read more about IA 8864 Biodiesel Blended Fuel Tax Credit 41-149.

A bigger difference between the two states is how the exemptions to the tax work. 100001 plus has an Iowa inheritance tax rate of 15. In 2013 the Indiana legislature repealed their inheritance tax completely.

0-50K has an Iowa inheritance tax rate of 10. On May 19th 2021 the Iowa Legislature similarly passed SF. These are briefly described below.

There are a number of categories of inheritor for the inheritance tax but only two are relevant for individuals. What is Iowa inheritance tax. That is worse than Iowas top inheritance tax rate of 15.

Over 50000 to 100000. Tax Rate D and Tax Rate E beneficiaries are for various types of organizations. Inheritance Tax Rates Schedule.

Tax Credits. Learn About Sales. If the net value of the decedents estate is less than 25000 then no tax is applied.

How much inheritance tax each beneficiary owes depends on the beneficiarys relationship to the deceased as well as how much the beneficiary inherited. This is for siblings half-siblings and children-in-law. 25001-75500 has an Iowa inheritance tax rate of 7.

Read more about Inheritance Deferral of. Iowa Inheritance and Gift Tax. Iowa Estate Tax IA 706 The Iowa estate tax is the amount of money the Internal Revenue Service Code allows as a credit against the federal estate tax owed by the estate less the Iowa inheritance tax paid.

The inheritance tax rate for Tax Rate B beneficiaries ranges from 5 to 10 and the inheritance tax rate for Tax Rate C beneficiaries ranges from 10 to 15.

States With Inheritance Tax Gobankingrates

Details On The Iowa Inheritance Tax Repeal Beattymillerpc Com

Another State Ditches Its Death Tax While Potential Backdoor Federal Estate Tax Looms

Do I Have To Pay Taxes When I Inherit Money

If You Want To Avoid Paying Lots Of Taxes You Might Want To Steer Clear Of The Northeast And Venture Towards Th Best Places To Retire Retirement Locations Map

Fact Check Republican Committee S Claim About The Estate Tax Isn T The Whole Story The Daily Iowan

Iowa Estate Tax Everything You Need To Know Smartasset

Estate And Inheritance Tax Iowa Landowner Options

If You Want To Avoid Paying Lots Of Taxes You Might Want To Steer Clear Of The Northeast And Venture Towards Th Best Places To Retire Retirement Locations Map

House Inheritance Tax Phaseout Differs From Aggressive Senate Plan Iowa Capital Dispatch

Iowa S Repeal To Leave Nebraska With Region S Only Inheritance Tax

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

Capital Gains Tax Calculator 2022 Casaplorer

Wealthy May Face Up To 61 Tax Rate On Inherited Wealth Under Biden Plan

Reynolds Signs Major Tax Cuts Into Law Promises More To Come Iowa Capital Dispatch

Should You Be Charging Sales Tax On Your Online Store Sales Tax Tax Filing Taxes

What Happened To The Expected Year End Estate Tax Changes